Let Me Clarify

Let Me Clarify

What was that Noise?

Do you hear all those voices too? No, I’m not talking about any voices in my head… I’m talking about the never-ending and ever-changing comments from “market gurus”, social media, the internet, and other media outlets. Many people, myself included, simply refer to it as “noise”.

Let me clarify.

We call it “noise”, because in most situations, it ends up being more of a distraction than actually constructive. Even today, take a look at any of the major financial news outlets. I’m willing to bet that on the same page you’ll see one extreme to another; from why the market will continue to boom to why a recession is coming and why you should be worried.

Something to consider when traveling down the rabbit holes of the internet is what the major job of the media is. Hint…clicks and viewers play a major role and it would be a good idea to at least question the validity/purpose of what you’re reading before taking it as gospel. At the same time, in most cases, the typical headlines of “markets fall as XYZ happens” tell us nothing other than two things have happened; and that they have already happened and are out of our control. Always remember the difference between correlation and causation. The market may go up or down on a Tuesday while it’s snowing in the northeast, but that doesn’t mean one caused the other.

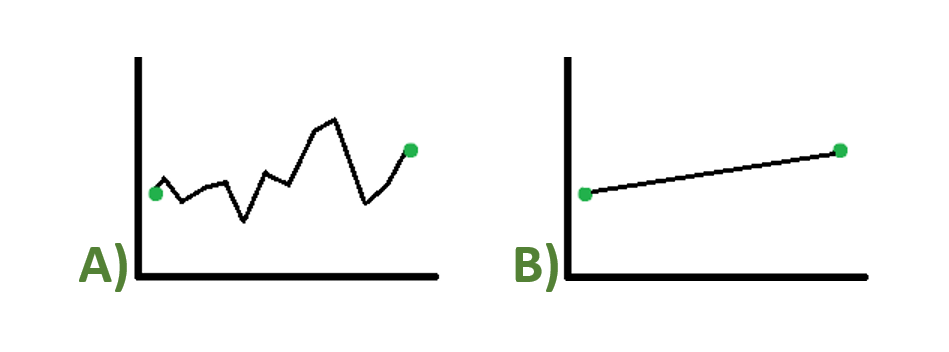

Consider the hasty-looking graphs below. What do you see when you compare the two?

Obviously, you notice the distribution of data points, but this can be a great representation of the mindset of two different investors. If Investor A and Investor B have the same portfolio and performance, what is the major difference?

What I’m illustrating here is Investor A who looks at the market every day and sympathizes with the headlines, while Investor B has a solid plan in place without the frequent concerns. I’d argue that volatility is subjective, and that market performance = your performance, but market volatility ≠ your volatility.

This is far from saying that you shouldn’t care about your money and the economy, but I am trying to distinguish between a well thought out plan that you have faith in vs. constant worry. If you’re simply following the headlines, I’d be concerned for your anxiety levels along with your money.

In reality, the majority of your financial success comes from behavior. As financial planners, after already accounting for volatility, we remain confident in our plans. The concern lies in whether you stick with the plan/approach or not.

So, the next time you hear a lot of noise, revisit the plan you have with the professional team surrounding you. It’s always a better option than panicking with the headlines or your brother’s wife’s cousin’s uncle’s impulsive advice.

As we embark on this clarifying journey together, I encourage you to submit any ideas, topics, or questions to info@clarifywealth.com. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendation for any individual. “Let Me Clarify” is a weekly blog containing Chad Baxter’s insights and thoughts about a variety of topics. To learn more about Chad, click here

This information is not intended to be a substitute for individualized legal advice. Please consult your legal advisor regarding your specific situation. Clarify Wealth Management and LPL Financial do not provide legal advice or services. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.